America's Income Tax Turns 100

"Prior to the enactment of the income tax, most citizens were able to pursue their private economic affairs without the direct knowledge of the government. Individuals earned their wages, businesses earned their profits, and wealth was accumulated and dispensed with little or no interaction with government entities."Passage of the 16th Amendment to the Constitution would forever change life in America and not for the better.

The 16th Amendment: The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.It's hard to imagine how this amendment could have been written any broader, or why 36 states would agree to such an open ended federal power to strip citizens of their rightful earnings via taxation without representation, and with literally no boundaries or limits to how far the federal government could and ultimately would go in their effort to buy the votes of some with the assets of others.

Since 1913, the federal tax code has been used as a primary tool of leftist social engineering in which the people have been forced to fund a government they no longer recognize and no longer support. The US Congress has a mere 11% approval rating today and the Executive branch is supported only by the 28% of citizens who benefit personally by the robbing of fellow citizens.

The states are now fiscal dependents of the federal government, and the federal government is a twenty trillion pound ape trampling through the rose garden of American life, and nobody seems to have any clue how to reign it all in.

[Source]

The Income Tax Turns 100 Years Old

February 2, 2013The Foundry - The federal income tax is now a centenarian. On February 3, 1913, the 16th amendment to the Constitution was ratified.

The revenue the income tax raises allowed Congress to greatly expand the size of the federal government. We will likely never return to a federal government the size we had before the 16th amendment became law.

Even though the income tax raises gargantuan amounts of revenue that allows for big government, it can only raise so much.

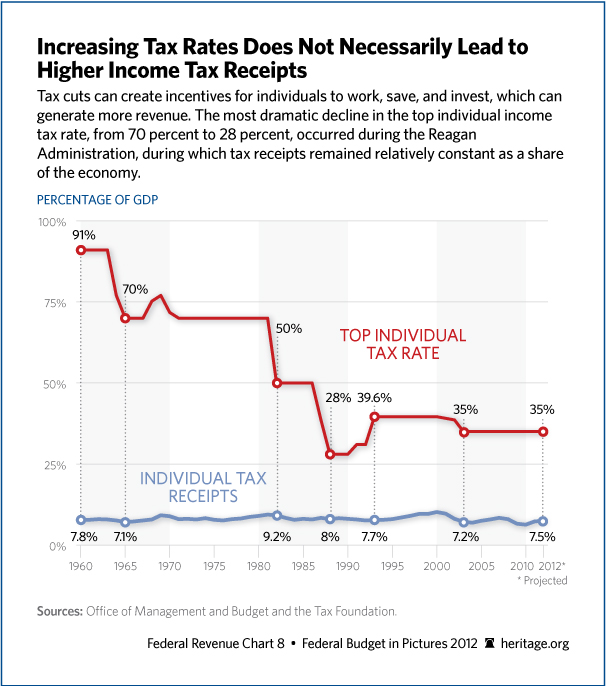

The individual income tax’s top rate has been as high as 91 percent as recently as 1960 and has been as low as 28 percent in the late 1980s. And yet the income tax raised on average 8 percent of gross domestic product (GDP) and had never exceeded 10.2 percent (reached only once in 2000 at the height of the tech bubble).

Higher income tax rates do not result in a gusher of revenue because, surprise, surprise, people respond to incentives. When rates are higher they work less, invest less, and take less risk. Some even renounce their citizenship. These predictable and sensible responses curtail the revenue gain from higher rates.

The natural cap put on income tax revenues by the instinctive reaction of taxpayers is an obstacle for those, like President Obama, that want to expand the federal government beyond its already bloated size.

They need more revenue to pay for spending they desire, but they can’t get it from the income tax. The recent increase of the top rate to 39.6 percent will do almost nothing to reduce deficits and debt, but it will cause considerable damage to the fragile economy. Further increases won’t change our debt picture either, but would do even more harm to the economy.

A great danger lies in giving Congress the authority to levy broad-based new taxes like a value-added tax (VAT) or carbon tax. These would allow the government to grow even bigger, just like the income tax did 100 years ago. Adopting such new taxes is the only way believers in big government can get the revenue they so badly want.

While fighting back the income tax today is a challenge, we can stop the imposition of new taxes that will allow the government to grow even larger. If we don’t, our descendants will be looking back 100 years from now lamenting our failure to stop those taxes the same way we lament our ancestors giving us the income tax.

Yes, it was 100 years ago that we wound up with a national income tax

February 4, 2013The Civil War income tax instituted by the Union was one of several financing tools it used against the Confederacy. The government also issued bonds and used excise taxes.

The Union’s income tax went away during the period of Reconstruction, with the idea of an income tax returning two decades later.

Author John Steele Gordon wrote a nice, short history of the income tax in 2011 for The Wall Street Journal, beginning with the Civil War and concluding with the 14th Amendment and its immediate aftermath.

Steele says the combination of a huge government surplus and a heavy tax burden on consumers led President Grover Cleveland’s administration to pass a second income tax law in 1894.

“The new tax, however, was very different from the Civil War income tax, which had exempted only the poor. The new one hit only the rich, imposing a 2 percent tax on incomes above $4,000. Less than 1 percent of American households in 1894 met that income threshold,” said Steele.The second income tax law was soon overturned by the Supreme Court in the 1895 decision of Pollack v. Farmers’ Loan & Trust.

In a 5-4 decision, the court said the Cleveland income tax was a direct tax that violated a constitutional provision because it taxed interest, dividends, and rent. That act violated Article 1, Section 2 of the Constitution, which required such taxes to be imposed in proportion to states’ population.

By the time President Taft took office in 1909, the public outcry grew over a tax system that undertaxed the rich and overtaxed the poor.

“The decision in the Pollock case left power in the National Government to levy an excise tax, which accomplishes the same purpose as a corporation income tax and is free from certain objections urged to the proposed income tax measure,” he said.The president then defined a basic two-tax system where income taxes were collected from citizens and businesses. He also understood that the amendment wouldn’t allow the Supreme Court to overturn a personal income tax based on the Pollack decision.

“I recommend, then, first, the adoption of a joint resolution by two-thirds of both Houses, proposing to the States an amendment to the Constitution granting to the Federal Government the right to levy and collect an income tax without apportionment among the several States according to population; and, second, the enactment, as part of the pending revenue measure, either as a substitute for, or in addition to, the inheritance tax, of an excise tax upon all corporations, measured by 2 percent of their net income,” Taft said.Congress passed its resolution about the 16th Amendment a month later, but the amendment wasn’t ratified until early 1913, when Delaware became the 36th state to approve it.

Incoming president Woodrow Wilson pushed for the Revenue Act of 1913, which included the income tax along with changes in tariffs.