The Pace of Healing in the Housing Market is Losing Steam

This Is the Housing Chart That Keeps One Economist Up at Night

June 12, 2015Bloomberg - It’s the one chart that keeps Stan Humphries up at night.

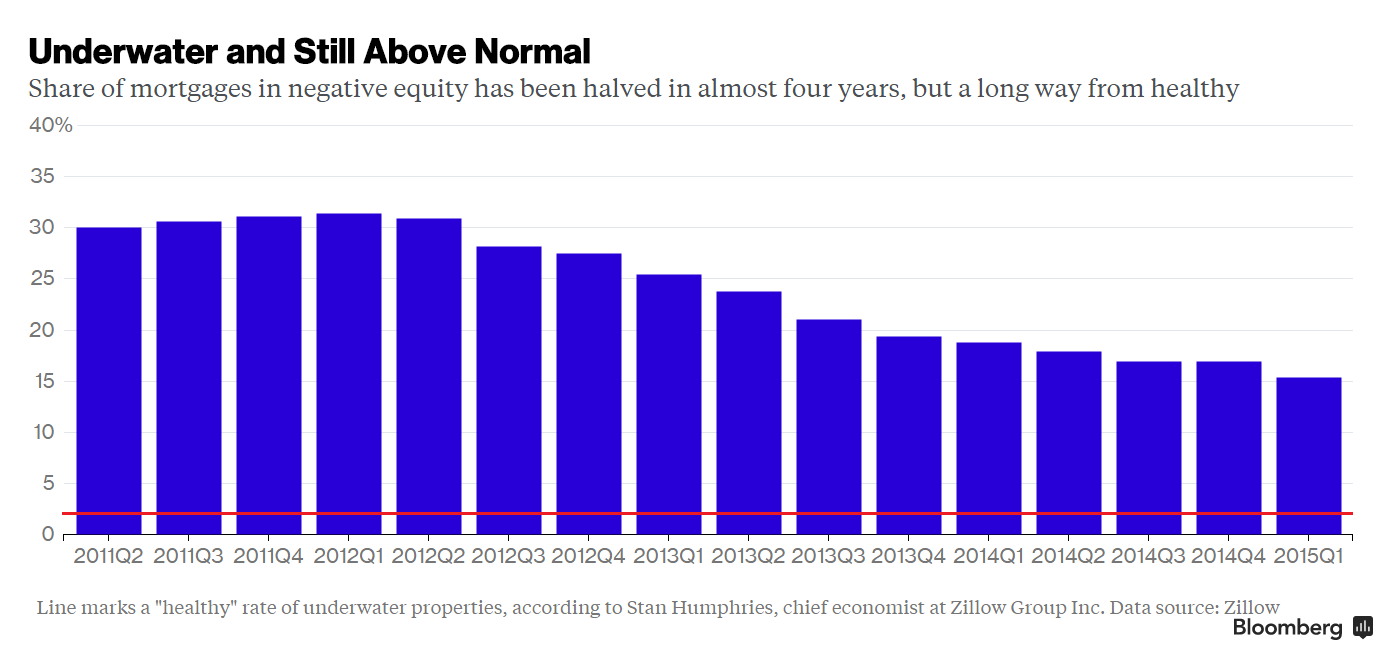

A decade after U.S. home sales peaked, 15.4 percent of owners in the first quarter owed more on their mortgages than their properties were worth, according to a report Friday by Zillow Inc. While that’s down from a high of 31.4 percent in 2012, it’s still alarmingly above the 1 or 2 percent that marks a healthy market, said Humphries, the chief economist at the Seattle-based real-estate data provider. Worse yet: The pace of healing is losing steam.

• Share of mortgages in negative equity has been halved in almost four years, but a long way from healthy

The blotch stains the economy by restraining the housing recovery and by preventing the job market from becoming even more vigorous. It also will probably exacerbate wealth inequality for years to come as homes valued in the bottom third of the market are more likely to be underwater.

“There’s a large swath of the housing market which could become quite static, which creates real long-term problems,” Humphries said.

The problem “was kind of on a glide-slope to fade away and it’s now circling the airport,” said Humphries.Home Appreciation

While the healthiest way for the underwater mortgages to heal is through home-price appreciation, those increases are diminishing. Residential property values nationally rose 4.14 percent in March from the prior year, according to the S&P/Case-Shiller index. The gauge has decelerated each month since the end of 2013, when it climbed 10.8 percent.

“I expect a more moderate pace of home-price appreciation,” said Greg McBride, senior financial analyst for Bankrate Inc. in North Palm Beach, Florida. Therefore, the progress in rebuilding home equity “is unlikely to come as quickly in the next three years as it has in the last three.”The prospect of having so many properties lingering underwater, probably for another five or six years, is what unsettles Humphries.

“The problem you could be creating is 15 to 20 percent of the housing stock becomes non-tradeable, which means inventory shortages continue, prices remain very spiky because liquidity is thin, and foreclosures remain very high,” he said.Less Spending

People with no equity in their homes also have little spending power to renovate them, devaluing the stock further, according to Nicolas Retsinas, director emeritus of Harvard University’s Joint Center for Housing Studies in Cambridge, Massachusetts, and a member of the board of directors at Freddie Mac.

Additionally, homeowners might hesitate to move until they have at least 20 percent equity in their homes in order to have enough cash for a down payment on a new property, crimping mobility.

With more Americans staying put, the labor market and broader economy also suffer from less vitality, said Retsinas.

“It tethers people to their homes so it reduces the labor mobility that’s important in a healthy, growing economy,” he said. Underwater mortgages are “one more pothole.”

Still a Strain

While the central bank chief sees slow and steady easing of underwater properties as home prices and credit availability increase, it remains a strain.

“I would score this headwind as still a concern, but one that is likely to continue to fade,” she said.

Two Countries“This is the tale of two countries,” said Julia Gordon, director of housing finance and policy at the Center for American Progress, a Washington advocacy group closely aligned with the Barack Obama administration.

“In one country, you have this depression in the housing market,” said Gordon. “There’s no reason for people to move there, so you can’t either fix the negative equity or fix the growth problem.”

Conversely, “in the places where there are opportunities, housing is insanely unaffordable -- both homeownership and rental,” she said.

Among the 50 largest metropolitan statistical areas in the Zillow data, San Jose, California, had the smallest share of negative equity, at 3.8 percent, and San Francisco and Buffalo, New York, each showed 6.1 percent. Las Vegas and Virginia Beach, Virginia, had the highest, at 25 percent.

San Jose and San Francisco also ranked Nos. 1 and 2 on Zillow’s list of the highest monthly rents in 2014. San Francisco showed the biggest appreciation in home prices in the year ended March, S&P/Case-Shiller data show.

The market’s inability to quickly rebound since the last downturn has made Americans pessimistic about housing. Families are now less likely to build equity through homeownership than they were 20 to 30 years ago, according to 62 percent respondents in a poll by the Chicago-based MacArthur Foundation issued Tuesday. About the same share, 61 percent, said they believe the U.S. remains in the throes of the housing crisis.

“Negative equity doesn’t get discussed as much because we don’t see people getting thrown out of their homes by sheriffs and foreclosure auctions anymore, or as much,” said Zillow’s Humphries. “That’ll be heating up again as a topic. It’s not getting better.”

No comments:

Post a Comment