U.S. Won't Prosecute the Too-Big-To-Fail Banks for Financial Terrorism But Will Prosecute Others

Jury Convicts Exec in $3b Mortgage Fraud Case

April 19, 2011AP – A jury on Tuesday convicted the majority owner of what had been one of the nation's largest mortgage companies on all 14 counts in a $2.9 billion fraud trial that officials have said is one of the most significant prosecutions to arise from the nation's financial crisis.

Prosecutors said Lee Farkas led a fraud scheme of staggering proportions for roughly eight years as chairman of Florida-based Taylor Bean & Whitaker. The fraud not only caused the company's 2009 collapse and put its 2,000 employees out of work, but also contributed to the collapse of Alabama-based Colonial Bank, the sixth-largest bank failure in U.S. history.

The jury returned its verdict late Tuesday after more than a full day of deliberations.

Colonial and two other major banks — Deutsche Bank and BNP Paribas — were collectively cheated out of nearly $3 billion, prosecutors estimated. Farkas and his cohorts — six of whom entered guilty pleas to related charges and testified against him at the two-week trial in U.S. District Court — also tried to fraudulently obtain more than $500 million in taxpayer-funded relief from the government's bank bailout program, the Troubled Asset Relief Program (TARP).

While TARP at one point gave conditional approval to a payment of roughly $550 million, ultimately neither Taylor Bean nor Colonial received any TARP money, and investigators from that office, along with the FBI and other agencies, helped uncover the fraud.

Neil Barofsky, who recently resigned as TARP's special inspector general, has called the Farkas case "the most significant criminal prosecution to date rising out of the financial crisis."

In a conference call Tuesday evening with reporters, the Justice Department's criminal division chief, Lanny Breuer, said Farkas was "one of the masterminds in one of the largest bank frauds in history" and that his misconduct "poured fuel on the fire of the financial crisis."

"TBW was a major, major player in this industry," perhaps the second largest in the country depending on how it is measured, Breuer said.

Farkas testified in his own defense at the trial and claimed he did nothing wrong. He claimed he was unfamiliar with details or knowledge of many aspects of the various fraud schemes, testimony prosecutors derided as incredible in their closing arguments.

Farkas' lawyer, Bruce Rogow, said the six executives at Colonial and Taylor Bean who struck plea deals skewed their testimony to bolster the government's case in the hope of receiving lighter prison sentences for their cooperation. Rogow said Farkas and everyone else at Taylor Bean was working honestly and ethically to get control of its finances and perhaps could have done the job if the government hadn't essentially shut the company down when it raided company headquarters in 2009.

Rogow said late Tuesday he was disappointed in the verdict and plans to appeal.

"I had hoped the jury would have accepted our argument that the six people who pled guilty did so not because they felt they were guilty but because they wanted to minimize the sentences that the government threatened them with," Rogow said.

U.S. District Judge Leonie Brinkema ordered marshals to take Farkas into custody immediately following the verdict, a relatively unusual step since most defendants are allowed to remain free until they are formally sentenced. Farkas will be sentenced July 1 and potentially could spend the rest of his life in prison.

According to prosecutors, the fraud began in 2002, when Taylor Bean overdrew its main account with Colonial by several million dollars. Mid-level executives at Colonial agreed to transfer money into Taylor Bean's accounts at the end of each day to avoid generating overdraft notices, a process known as "sweeping."

As the hole grew to well over $100 million, Taylor Bean and a handful of Colonial executives concocted a scheme in which Taylor Bean sold hundreds of millions in worthless mortgages to Colonial, mortgages that had already been sold to other investors. More than $1 billion in such phony mortgages were eventually sold to Colonial, which listed them on its books and on its quarterly reports as legitimate assets, prosecutors alleged.

In a related scheme, Taylor Bean created a subsidiary called Ocala Funding that sold commercial paper — essentially glorified IOUs — to banks including Deutsche Bank and BNP Paribas. But prosecutors said the collateral that supposedly backed that commercial paper was worthless, and when Taylor Bean collapsed in 2009, the two banks lost roughly $1.5 billion.

Prosecutors said Farkas was motivated by greed and a lavish lifestyle that included a private jet, a seaplane, numerous houses including a home on Key West that he paid servants to hand wash with a sponge to prevent salt damage, a collection of several dozen classic cars and an executive dining room at company headquarters that served pheasant and caviar.

Farkas, 58, was charged with 14 counts of bank fraud, wire fraud, securities fraud and conspiracy.

Trial testimony revealed that the bankers at Colonial who worked with Farkas felt trapped as the hole in Taylor Bean's accounts grew exponentially. Cathie Kissick, a vice president at Colonial who did not tell her superiors about the vast majority of Taylor Bean's problems, testified that she had little leverage over Farkas because of the trouble she would be in if the size of the hole in Taylor Bean's accounts was discovered.

Farkas exploited that leverage, telling a colleague:

"If I owe you $100, I have a problem. If I owe you $1 million, you have a problem."

America Is a Failed State Because It Won’t Prosecute Financial Crime

April 15, 2011Washington’s Blog - It is now mainstream news that none of the big financial criminals have been prosecuted.

The New York Times is running an article today entitled “In financial crisis, no prosecutions of top figures”, which has been picked up as the leading front-page story by MSNBC. The story even quotes Bill Black:

But their policies have created an exceptional criminogenic environment. There were no criminal referrals from the regulators. No fraud working groups. No national task force. There has been no effective punishment of the elites here.

And the chair of the Financial Crisis Commission, Phil Angelides, said today:

I think there’s a great concern in this country on two fronts. One is there’s a question here, do we have a dual justice system? One for ordinary people and then one for people with money and enormous wealth and power. Secondly, we need deterrents. To the extent laws were broken, we need deterrents. If someone robs a 7-11, they took $500 and they were able to settle the next day for $50 and no admission of wrongdoing, they’d knock over that 7-11 again. And we’ve seen time after time where people and firms have made tens, one hundreds, billions of dollars. They’ve settled charges for pennies on the dollar. At Citigroup for example they represented that they had $13 billion of subprime mortgage exposure when they really had $55 billion. The penalty to the chief financial officer who made $19 million that year, 2007, was $100,000. Goldman was fined $500 million but the date they settled their stock moved up $2 billion. There’s been no real consequence.

Well I think there’s two things here. Number one is it’s up to the prosecutors to do thorough investigations. That’s what we should expect. We don’t want hangmen justice. We don’t want vengeance, but we want thorough investigations. And if people crossed a line they ought to be prosecuted. But there were a lot of people who bellied up to the line and conducted themselves in a way without the highest standards of ethics or moral conduct that hurt the economy badly.

And I think one of the things that’s most troubling to people is there seems to be very little relationship between who drove this crisis, the big financial institutions, the CEOs, regulators who didn’t do their job, and the people who are paying the price, which are millions of people who have lost their jobs, lost their homes, lost their life savings.

As I’ve previously noted, Nobel prize winning economist Joseph Stiglitz, former Fed chairman Alan Greenspan and a host of other well-known financial names have called for prosecution, because the economy cannot recover until fraud is prosecuted.

But Wall Street is so thoroughly in control of both parties, Congress, the White House, and even the judiciary, that prosecutions won’t happen.No wonder Marc Faber calls the U.S. a failed state, Kenneth Rogoff says our tax systems are “Byzantine labyrinths funelling money to powerful interests”, and experts on third world banana republics from the IMF and the Federal Reserve have said the U.S. has become a third world banana republic.

Bill Gross, Nouriel Roubini, Laurence Kotlikoff, Steve Keen, Michel Chossudovsky, the Wall Street Journal, Bernie Madoff and a prominent Chinese economist and former adviser to the country’s central bank and many other top financial experts say that the U.S. is a giant Ponzi scheme. Most other developed countries are as well.

They’ve been impoverished and subjected by the pyramid schemes of the big banks. See this and this.

A Crisis That’s Four Times Bigger Than 2008

April 19, 2011Graham’s note: The following is an excerpt from my most recent Private Wealth Advisory newsletter. In it I explain why the Fed will perform QE 3 and kill the US Dollar in the process. In this same issue, I alerted subscribers to three new inflation hedges that will produce out-sized gains from the Fed’s madness. These three come on the heels of the three investments detailed in my Inflationary Storm Pt 2 Report (one of which has already been bought out for a 41% gain). To learn more about Private Wealth Advisory click here.

Gains, Pains & Capital - The financial world is awash with a debate as to whether the Fed will engage in QE 3 in the future. To me this debate is pointless.

Indeed, the Fed HAS to engage in more QE 3 if it doesn’t want the entire market to collapse. Given the breakdown in Europe, the IMPLOSION in the Middle East, and the ongoing nuclear disaster in Japan, the removal of Fed liquidity would kick off a MASSIVE systemic Crisis.

Remember, we had a full-scale market breakdown when QE 1 ended and that was because of Greece: a country with a GDP of $329 billion. Removing liquidity from the markets when Japan, the fourth largest economy in the world (if you count Europe as one economy), the largest Oil exporting region in the world (the Middle East), and Spain and Portugal are all breaking down would lead to an absolute market DISASTER.

The Fed will not risk this. Besides it HAS to keep the liquidity going if it’s to continue supporting the TBTF banks in the US. Remember, 99% of what the Fed’s done in the last two years has been aimed at supporting the large, Too Big To Fail (TBTF) Wall Street banks. The reasons for this are:

1) The Fed is in fact CONTROLLED by these banks via the Primary Dealer network

2) Fed leaders are all front-men for Wall Street

In order to understand these, you need to know that the REAL power of the Fed lies in its primary dealer network, NOT stooges like Ben Bernanke.

If you’re unfamiliar with the Primary Dealers, these are the 18 banks at the top of the US private banking system. They’re in charge of handling US Treasury Debt auctions and as such they have unprecedented access to US debt both in terms of pricing and monetary control.

The Primary Dealers are:

1. Bank of America

2. Barclays Capital Inc.

3. BNP Paribas Securities Corp.

4. Cantor Fitzgerald & Co.

5. Citigroup Global Markets Inc.

6. Credit Suisse Securities (USA) LLC

7. Daiwa Securities America Inc.

8. Deutsche Bank Securities Inc.

9. Goldman, Sachs & Co.

10. HSBC Securities (USA) Inc.

11. J. P. Morgan Securities Inc.

12. Jefferies & Company Inc.

13. Mizuho Securities USA Inc.

14. Morgan Stanley & Co. Incorporated

15. Nomura Securities International Inc.

16. RBC Capital Markets

17. RBS Securities Inc.

18. UBS Securities LLC.

Of this group four banks in particular receive unprecedented favoritism of the US Federal Reserve. They are:

1. JP Morgan

2. Bank of America

3. Citibank

4. Goldman Sachs

You’ll note that these are the firms deemed “Too Big To Fail.” The Fed not only insured that they didn’t go under during 2008, but in fact allowed these firms to INCREASE their control of the US financial system.

Consider that JP Morgan took over Bear Stears. Bank of America took over CountryWide Financial and Merrill Lynch. Citibank and Bank of America were the only two banks to have their liabilities directly backed by the Fed ($280 billion for Citi and $180 billion for BofA).

Then there’s Goldman Sachs which was made whole from all AIG liabilities, received $13 billion in direct funding from the Fed, and was supported while ALL of its investment bank competitors either went under or were consumed by other entities, granting Goldman a virtual monopoly over the investment banking business (the firms that were merged with larger firms all laid off large portions of their employees and closed down whole segments of their business).

My point with all of this is that we NEED to ignore what the Fed says and instead focus on what it does. And in the last two years, the Fed has done everything it can to support these four firms. Indeed QE’s 1, 2, and the coming 3 are nothing but an attempt to funnel TRILLIONS into these firms (and the other primary dealers).

The reasons the Fed is engaging in QE rather than simply dishing out the funds are:

1. Political outrage would be EXTREME if the Fed just gave the money away

2. The Fed needs to support those firms with the largest derivative exposure

The reason that the 2008 debacle happened was very simple. The derivatives market, the largest, most leveraged market in the world.

Today, the notional value of the derivatives sitting on US banks’s balance sheets is in the ballpark of $234 TRILLION. That ‘s 16 times US GDP and more than four times WORLD GDP.

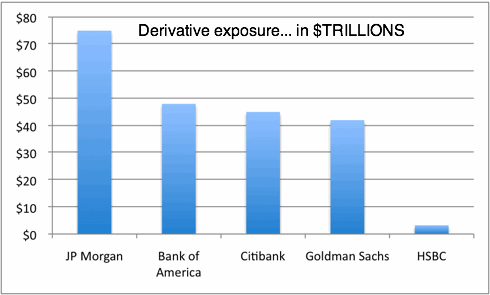

Of this $234 trillion, 95% is controlled by just four banks. Those four banks and their derivatives exposure (in $ TRILLIONS) are charted below:

The above picture summates two things:

1) Who REALLY controls the US financial system

2) Why QE 3, 4, etc are guaranteed

The Fed HAS to continue pumping money into the system to support these firms’ gargantuan derivative exposure. Failing to do so would mean a disaster on the scale of four to five times that of 2008.

Remember 2008 was caused by the credit default swap market which was $50-60 trillion in size. The interest-rate derivate market is $200+ TRILLION in size.

So I am certain QE 3 will be coming. If it doesn’t come in June we’ll get hints of it until it’s finally announced. The Fed cannot and will not stop the money printing. Bernanke will be forced to resign long before he takes the paperweight off the print button. Small wonder then that the US Dollar is falling off a cliff. Indeed, the way things are going, the Fed will push into a full-scale inflationary collapse within three months.

So if you’re not preparing for mega-inflation already, you need to start doing so NOW. The Fed WILL continue to pump money into the system 24/7 and it’s going to result in the death of the US Dollar.

No comments:

Post a Comment