Fed Members State That Their Intention Is Not to Support the Stock Market

My Skepticism About QE3

August 14, 2011Leeds on Finance - Many analysts and Fed-watchers are predicting QE3. As an example, The Wall Street Journal reported that Goldman Sachs’ new “base case” scenario is that the Fed will launch a new round of bond buying later this year or next year. I’m skeptical about this (although I’m certainly far from sure) and I’ll tell you why:

1. The fact that three members of the FOMC dissented this past week (when the Fed committed to keeping the Fed funds rate near zero for two years) shows relatively strong opposition to greater accommodation. Minnesota Fed President Narayana Kocherlakota explained that inflation has risen and unemployment has fallen since last November. According to Kocherlakota, providing more accommodation is not the proper response.

2. We saw commodity price inflation during QE2. The Fed argued that commodity prices were increasing due to other factors (such as emerging market demand). If the Fed engages in QE3 and commodity prices increase, it’s going to be hard to blame other factors. In effect, we risk angering the rest of the world.

3. When Bernanke started discussing QE2 in Jackson Hole (Aug. 2010), rates dropped and the stock market started rallying. I’m not convinced that Bernanke believes that he needs to actually engage in QE3 in order to obtain the benefits. I think that he may believe he can hold the possibility (of QE3) out there – and still get the benefit without incurring the wrath.

4. After the recent debt ceiling debacle and a weak 30-year Treasury auction last week, QE3 will further the appearance that we are “monetizing the debt.”

5. Banks don’t need more excess reserves. That’s not going to solve our unemployment problem, our housing problem or our weak demand problem.

6. I don’t think QE3 is consistent with Bernanke’s view of how Fed policy impacts the stock market. I reviewed an article written by Chairman Bernanke and Kenneth Kuttner (at Oberlin College when he wrote this paper, but currently at Williams College), titled “What Explains the Stock Market’s Reaction to Federal Reserve Policy?” (Journal of Finance, 2005). In the paper, Bernanke and Kuttner conclude that a decrease in the Fed funds rate does not affect real rates for a long period of time. Rather, the reason that a drop in rates leads to an increase in stock prices must come from either changes in expected dividends (cash flows) or changes in expected future stock returns (lower rates may lower the required equity premium).

They stated that lower rates could decrease the riskiness of stocks directly (by lowering the interest costs or strengthening the balances sheets of publicly owned firms) or by increasing the willingness of stock investors to bear risk. Ultimately, I don’t think that Bernanke sees a need to improve the balance sheet of firms (at the current time). In addition, rates are low enough already to push investors into riskier assets.

If anything, I think that there will be a desire to make stocks more attractive by repositioning the Fed’s portfolio and buying longer-term bonds. Keeping long-term rates low will ultimately give investors no choice but to buy risky assets.

7. If we push interest rates any lower, we start looking more and more similar to Japan.

8. We risk creating future bubbles when we keep interest rates too low.

We’ll see what happens. Many sophisticated Fed watchers are predicting that QE3 will happen – and they may very well be right. But, I’m skeptical. Of course, maybe it’s just wishful thinking on my part

QE2 Winners Not Forecasting QE3 Jackson Hole Miracle

August 18, 2011Ciovacco Capital Management - In 2009 and 2010, the Federal Reserve was able to reverse sharp declines in asset prices by pumping large amounts of printed money into the global financial system via quantitative easing. With the Fed’s 2011 Jackson Hole speech set to take place on August 26, we recently reviewed the ETF winners from QE2 looking to see if the market is anticipating the launch of QE3.

Like the bearish similarities to 2008, our findings below are not encouraging for the stock market bulls. A recent review of QE2 winners indicates one of two things:

- The market does not believe the Fed will announce QE3 in the coming weeks or

- The market believes the deflationary forces in the economy are so great that QE3 would have little impact on asset prices.

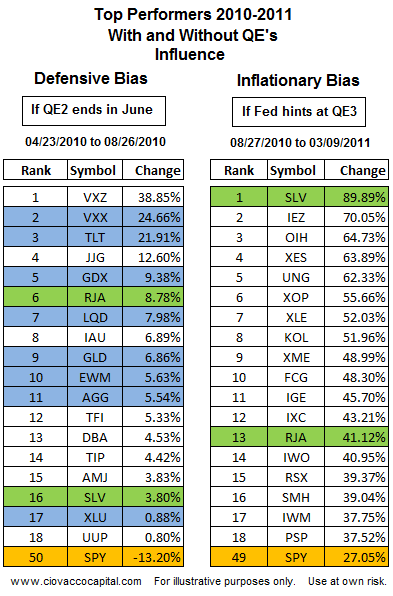

The Fed clearly telegraphed their intention to implement QE2 during Ben Bernanke’s remarks at Jackson Hole on August 27, 2010. Our March 2011 analysis of QE2 winners showed that silver (SLV) prices responded by gaining almost 90% from August 2010 to March 2011. The table below was originally presented in March 2011.

The 2011 Jackson Hole remarks from the Fed are scheduled for August 26; last year they were given on August 27. This year the financial markets peaked in early May; last year markets were also topping out in May, which means we have similar conditions coming into this year’s Jackson Hole remarks as we did in 2010.

Unfortunately for the bulls and the global economy, the rest of the QE2 investment winners do not support another QE miracle save from the Fed.

Click here to see the charts.

[...]In the summer of 2010, global financial markets were sitting on a fine bull/bear demarcation line as we outlined in this August 15 video. The Fed’s August 2010 Jackson Hole speech telegraphed the central bank’s intention of launching QE2. The impact on asset prices was dramatic in 2010.

Even if QE3 is announced, the impact may be much more muted in 2011. Our 2011 Jackson Hole strategy is to review the Fed’s remarks with an open mind. We will also review the market’s response with an open mind, but as of this writing, our bias heading into the Fed’s annual summer conference will remain defensive and bearish.

Federal Reserve Might Not Undertake QE3, and It Might Not Help If They Do

Only a few months ago, Fed supporters praised the Fed for boosting the stock market. Now Fed members state that their intention is not to support the stock market. Someone here has a serious case of schizophrenia.August 13, 2011

Huffington Post - With the economy growing at a snail's pace and the job market still disconcertingly weak, economists are wondering whether the Federal Reserve will undertake a new round of stimulus efforts to keep the country from slipping into a double-dip recession. Even if the Fed goes that route, however, it may not have much of an effect.

Such a program would be known as QE3 -- a third session of quantitative easing, which the Fed has done twice before. "Quantitative easing" refers to the Fed buying up assets, particularly longer-term Treasury bonds, as a way of pumping more money into the economy and stimulating investment.

Both rounds of quantitative easing have occurred during the current economic crisis, with the previous round, known as QE2, lasting from November 2010 to June of this year. Economists gave it decidedly mixed reviews.

At the end of QE2, unemployment was still high, GDP growth was discouragingly slow and consumer spending was on the way down.

Critics of quantitative easing say that not only was the second round ineffective, but the influx of new money put the country at greater risk of inflation. Nevertheless, stimulus advocates are keeping a close eye on the Fed, looking for signs that QE3 is on the way.

Not everyone believes that it is.

"The hurdles facing QE3 are very high," said David Jones, an executive professor of economics at Florida Gulf Coast University's Lutgert College of Business. "It’s not off the table completely, because if we do have a double-dip, anything is on the table. But it's off the table for now."

Jones told The Huffington Post that QE2's opponents criticized the program so ardently -- both in the U.S., where analysts worried about inflation, and overseas, where the flood of new dollars was seen as tipping the international trade balance unfairly in America's favor -- that it's unlikely Federal Reserve Chairman Ben Bernanke will try a new round of bond-buying unless it's the only way to stave off disaster.

"The Fed is much better at pulling us back from the abyss -- like it did in the credit crisis of 2007-2008 -- than it is at trying to boost growth in a recovery," said Jones.

Even so, many economists believe QE3 is coming sooner or later. In a recent CNBC poll, 46 percent of economists surveyed said they expected the Fed to undertake a new round of easing, compared with just 37 percent who said it would not.

Earlier this week, Goldman Sachs researchers published a note saying that there is "no question" Bernanke will have enough votes on the Federal Open Market Committee to implement QE3, and that they "fully expect him to use these votes ... if he views it as necessary." Analysts from Harvard, Credit Suisse, Standard Life and a number of other institutions have also said that QE3 seems like a distinct possibility.

For its part, the Fed has said only that it plans to keep interest rates near zero through the middle of 2013, as a way to encourage corporate borrowing and investing. On Tuesday, a day after the Dow plunged more than 600 points in a single session, Bernanke said the Fed had "discussed the range of policy tools available to promote a stronger economic recovery" -- a phrase that many market participants have taken as a veiled reference to a new round of bond-buying coming up.

Drew Matus, a senior economist at UBS, says it would be a mistake to jump to that conclusion.

"In the context of a market that had been down very sharply the day before, that was them reassuring people that they still have ammunition," Matus told The Huffington Post.

The markets did seem placated after Bernanke’s remarks, rallying to finish up more than 400 points on the day.

But while Bernanke may have the power to move markets in the short term, there are doubts as to whether new easing efforts would even have the desired expansionary effect. Jones told The Huffington Post that the country is reaching a point of "diminishing returns" with its asset-purchasing programs, and inflation hawks have argued that QE3 would drive up the price of commodities like gas and oil, leaving consumers unable to spend money on anything but necessities.

QE3 speculation could rise to a fever pitch in the next couple of weeks, as many believe the Fed will save any major statements for its August 26 conference in Jackson Hole, Wyo. It was at this conference last year that Bernanke indicated that QE2 was on the way.

Matus, for one, doesn’t expect a similar announcement this time.

"UBS's view is that [QE3] is not going to happen," he said. "In my mind, Bernanke hasn’t got as much flexibility as a lot of people think he does."

No comments:

Post a Comment