Private Owners of Greek Debt Forced to Swallow Losses But Not the European Governments or the European Central Bank

[2011 Source]

Rival accuses Germany's Merkel of deceit over euro zone bailouts

Private owners of Greek debt were forced to swallow significant losses on their holdings in 2012, but European governments and the European Central Bank, which bought up Greek bonds at the height of the crisis, have refused to take a hit.July 21, 2013

"As such, the illusion about not being a union of joint liability would burst like a bubble - possibly even before the federal elections," Steinbrueck told Wirtschaftswoche.He added it could "not be excluded in any way" that other countries might need further financial help after the election.

Many debt experts believe Europe will have to write off some bailout loans to Greece if the country is to make a successful return to capital markets.

The International Monetary Fund said last month Athens may require additional debt relief as early as next year, although it did not specify what the relief might look like.

Merkel and her government have in recent weeks repeatedly ruled out a further writedown of Greek debt.

An open debate about loan losses could damage Merkel in the run-up to the vote. She is tipped to win a third term, in part because voters believe she has shielded them from such losses during a debt crisis that first erupted in Greece in late 2009.

Who Holds Greek Debt?

April 24, 2011GreekDefaultWatch.com - As talk grows of Greece restructuring its debt, it is important to take a look at who really holds Greek debt and who will be affected by a potential restructuring. At the end of 2010, the Ministry of Finance (MOF) reported that the Greek government had an outstanding public debt of €340 billion, of which €286 billion was in the form of bonds and short-term notes and €54 billion in the form of loans (see here). Dissecting who holds that debt, however, is a murky exercise. Below is my effort to reconcile the numbers – these are estimates at best and I hope to revisit these numbers as better information becomes available (the graph shows Q3 2010 because that is the last date for which all data is reported).

The main source for separating domestic versus foreign debt is the Bank of Greece (BoG). The BoG reports the country’s International Investment Position (IIP), which is effectively the country’s assets versus its liabilities (here). At the end of 2010, the BoG reported external liabilities for the General Government of €149 billion (lines 2.2.2.1 + 2.2.2.2). There is also the debt to the Troika under the bail-out plan, which at the end of 2010 was valued at €40 billion (line 4.2.2.3 in the IIP, which also covers some other small liabilities).

There is another tranche, which is less clear cut: bank borrowing from the European Central Bank (ECB). Greek banks borrow from the BoG by posting collateral, including Greek government securities or loans; in turn, the BoG borrows from the ECB. Since these assets remain on Greek banks’ balance sheet, we can classify them as domestic liabilities. Therefore, foreign ownership of Greek debt equals €149 billion + €40 billion = €189 billion, or 56% of total government debt.

Foreign: Details

The Bank for International Settlements (BIS) publishes data on bank holdings of Greek public sector assets. So far, the BIS has only published data to Q3 2010, at which time foreign banks reported an ultimate exposure of $71 billion to public sector assets in Greece – or €53 billion (16% of total Greek public debt). The rest of Greek debt held abroad, therefore, belonged to non banks.

Looking at bank claims on the Greek economy, however, it is important to recognize that exposure to the public sector made up just 42% of the total. Exposure to banks was just 8%, while the rest was to the non-bank private sector (50%). Foreign banks also have exposures, comprising of ~$110 billion in derivatives, guarantees extended and credit commitments. If we add these to foreign claims, Greek government debt made up 26% of the total. Foreign banks, therefore, stand to lose more from the ripple effects of a default than from the mere write-down of Greek debt.

Domestic: The BoG publishes the Financial Soundness Indicators for Greek credit institutions, which measures, among others, the holdings of Greek securities and loans. At the end of 2010, these amounted to €63 billion, or 12.6% of total assets, which is important but not extreme, leaving €80 billion in the hands of non-credit domestic entities. Although exposure by credit institutions has remained fairly constant since July 2010, given the deteriorating position of Greek banks (see here), government assets form an increasing share of the overall portfolio: from 8.5% in January 2009 to 10% in January 2010 and 12.7% in January 2011. Any restructuring would have an increasingly significant impact on Greek banks.

So what does all this mean? At a high level, bank impairment is less of a risk than the overall balance sheet deterioration that would result from a default. In the foreign sector, claims on Greek government debt are important, but they are only a fourth of overall claims and other exposures on the Greek economy. Importantly, credit to the non-banking private sector is bigger than ownership of government securities.

In the domestic economy, government securities and loans form an ever increasing share of total assets for local banks, and they also form a main pillar of banks’ borrowing strategy. To put these numbers in context, the Greek banking sector has lost €26 billion in deposits since December 2009 – so a €63 billion write-down, even partial, would be big. Even so the non-banking sector would suffer even greater losses, further impairing the balance sheets of households, corporations and other institutions.

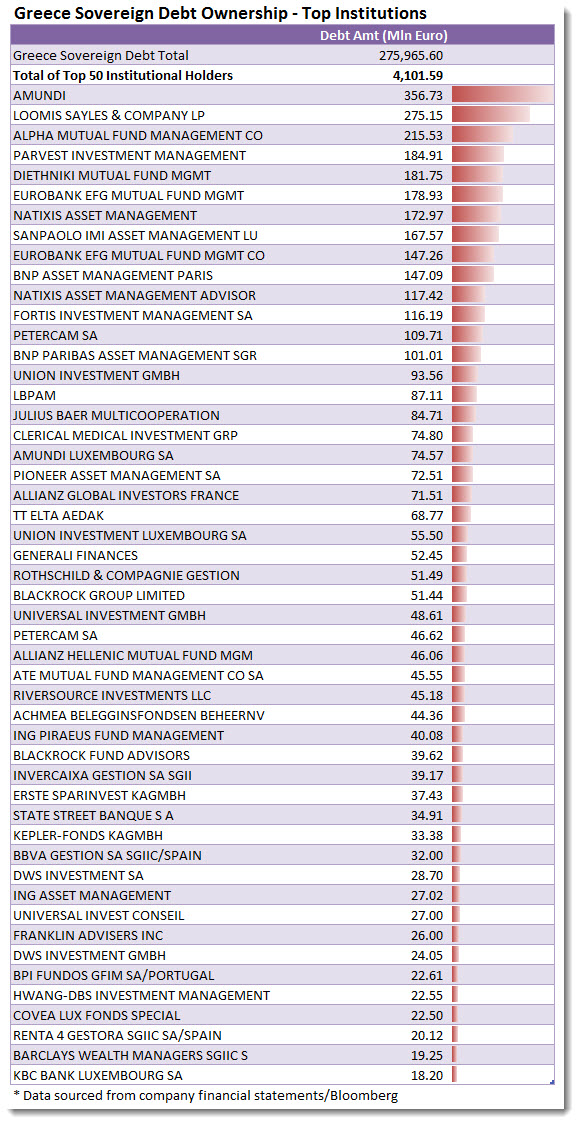

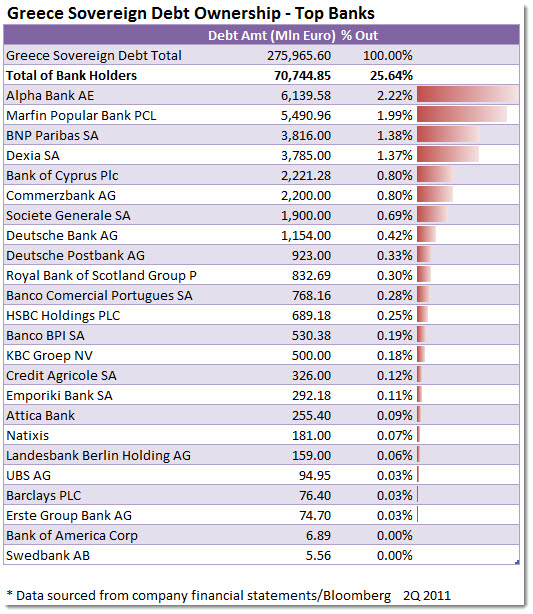

Who Owns The Greek Debt Anyway? A List of Banks and Institutions

TheDisciplinedInvestor - Bloomberg has scrubbed through statements and reports to put together some of the top holders of Greek debt. If you were wondering who are the parties at most risk, here you have it.