Oil Crash Will Transfer $3 Trillion Per Year from Oil Producers to Global Consumers

BofA: The Oil Crash Is Kicking Off One of the Largest Wealth Transfers in Human History

January 31, 2016Bloomberg - A $3 trillion shift. Economists are still hotly debating whether the oil crash has been a net positive for advanced economies.

Optimists argue that cheap oil is a good thing for consumers and commodity-sensitive businesses, while pessimists point to the hit to energy-related investment and possible spillover into the financial system.

A new note from Francisco Blanch at Bank of America Merrill Lynch, however, puts the oil move into a much bigger perspective, arguing that a sustained price plunge "will push back $3 trillion a year from oil producers to global consumers, setting the stage for one of the largest transfers of wealth in human history."

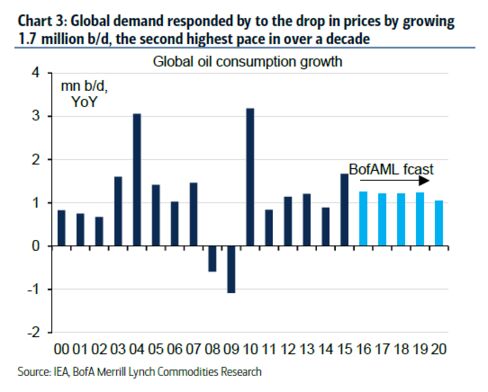

Blanch and his team already see evidence that the fall in the price of crude is having a positive impact on demand, and say that it could accelerate even further if prices don't pick up.

Says Blanch:

"Alternatively in a lower oil price scenario, e.g. if prices were to average just $40 over the next five years which is close to the current forward curve, demand would grow by 1.5 million barrels per day, which is 0.3 above our base case. Finally, at $20 oil demand would grow by an explosive 1.7 per year on average, 0.5 above the base case, on our estimates."Meanwhile, in emerging markets, where much of the story of late has been about disappointing economic growth, Blanch still sees huge upside potential in terms of automobile penetration and consumption.

Take China for example, where the strategist sees the oil plunge helping to fuel a boom in SUV sales:

"Moreover, the low oil price is encouraging Chinese consumers to buy increasingly larger cars. Sales of SUVs, the heaviest passenger vehicles category, are up 60 percent year-on-year in the last three months, while overall passenger vehicle sales are growing robustly at 22 percent."And it's not just emerging markets where the impact of cheaper gasoline is being seen.

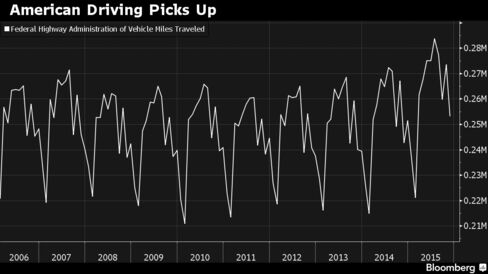

After years of stagnation, vehicle miles traveled in the U.S. clearly ticked higher in 2015.

Related:

Feds Will Use the Recent Drop in Gas Prices as an Excuse for a $10-a-barrel Tax on Oil

No comments:

Post a Comment