Obama Doesn’t Object to High Oil Prices as Long as They Come About Gradually

If past statements from Obama and his administration are any indication, the U.S. could be stuck with prohibitively high gasoline prices: Then-Senator Obama said on the campaign trail in 2008 that he doesn’t object to high oil prices as long as they come about gradually, and Secretary of Energy Steven Chu once famously said he hoped the U.S. would “boost the price of gasoline to the levels in Europe,” where prices are currently about $7 per gallon.Much could be done to increase the global supply of oil, but so far our politicians and the major oil company executives are sitting on their hands. They seem to like the increasing oil prices. According to Energy Analyst Peter Beute: Every penny increase at the pump takes $4 million per day from the American consumer. So a 10-cent increase is $40 million a day. - People of Earth: Prepare for Economic Disaster (Excerpt), The Economic Collapse, March 5, 2011

So for now it looks like oil prices will continue to rise, and this is going to result in much higher prices at the gas pump. Already, ABC News is reporting that regular unleaded gasoline is going for $5.29 a gallon at one gas station in Orlando, Florida. [A $10 increase in oil prices translates into roughly a 25 cent increase in retail gasoline prices.] - People of Earth: Prepare for Economic Disaster (Excerpt), The Economic Collapse, March 5, 2011

Oil Prices Plummet Nearly 9 Percent–Will Gas Follow?

May 6, 2011The Lookout - It's hard to blame Americans consumers--and drivers, in particular--for feeling a little confused this morning. After months of steadily rising commodities prices, that had helped send gas prices soaring to nearly $4 a gallon, the price of crude oil plummeted nearly 9 percent yesterday.

So what's going on--and with the Memorial Day kickoff to the summer driving season just a few weeks away, how will these fluctuations affect prices at the pump?

No one can really be sure what's behind the sharp decline--but experts pointed to several potential explanations:

Americans have been using a bit less gas lately. The downturn in demand is partially in response to the high prices. Energy Department statistics showed that for the 16th straight week, gas consumption dropped in comparison to 2010. Last week saw a 3.7 percent decline from the equivalent week last year.

Plus, the run of recent bad economic news--disappointing first quarter growth numbers, a mediocre private-sector jobs report, and a spike in initial jobless benefit claims--has created fear that the economy could slide back into recession, causing prices across the board to drop. Traders may have been anticipating that outcome, and thereby making it happen.

The valuation of the dollar has been rising in currency markets. This shift, which reflects a somewhat improved picture for U.S. trade, has the effect of driving down prices for all commodities denominated in dollars.

A price bubble may be deflating a bit. Industry analysts believe that oil prices have been too high--thanks in part to overblown fears about political instability in the Middle East--so the market was due for a correction. Other than in Libya, the turmoil in that region has not had a major effect on the supply of oil on the world market.

"At those elevated price levels, you had to take into account the risk of a pullback if there were not another supply shock," David Greeley of Goldman Sachs told the Washington Post.

Gas-price picture remains uncertain. So has the drop in oil prices brought gas prices down too?

Not yet: Yesterday, prices at the pump went up by a tiny amount, and were at $3.99 a gallon on average--still more than a dollar above where they were a year ago.

But experts say that gas prices should start falling in the next few days, likely in time for Memorial Day. "The driver can expect to see a slow erosion of prices," Tom Kloza of the Oil Price Information Service told the New York Times, predicting that by Memorial Day, gas would be at $3.75 a gallon, and could be at $3.50 later in the summer.

And Adam E. Sieminski, chief energy economist at Deutsche Bank, echoed that view, telling the Post that prices could ultimately drop by as much as 25 percent--back to around $3 a gallon, in other words.

Still, before hauling out the Winnebago for that cross-country road trip, drivers probably should still take any predictions with a grain of salt. Prices for oil and gas are dependent on so many diverse factors--and world events, especially lately, are so fast-moving and unpredictable that forecasting how things will look months from now is a long way from an exact science.

Gas Prices Could Slow Job Growth This Year

May 6, 2011AP – A brightened outlook for job growth may dim this spring as rising gas prices weigh on companies and prompt some to rethink their hiring plans. Analysts' consensus forecast is that the economy added 185,000 jobs in April and that the unemployment rate remained at a two-year low of 8.8 percent. That would be down from the 216,000 jobs added in March but still solid.

Still, just a few weeks ago economists were confident that private companies would add more than 200,000 jobs for the third straight month. Some now worry that the job figures could be weaker than expected, based on the most recent economic data.

"There are risks out there that job growth could slow sharply," said economist Chris Rupkey at the Bank of Tokyo-Mitsubishi UFJ. For now, Rupkey is sticking with his forecast that a net total of 170,000 jobs were created in April.He predicts that private employers added fewer than 200,000 jobs, while local governments shed positions.

But Rupkey is concerned that Friday's jobs figure could fall short of that.

Average gas prices have risen for 44 straight days. Consumers are spending more to fill the tanks, leaving them with less to spend elsewhere. As a result, many companies are feeling less certain about the economy's health.

Oil prices plummeted Thursday to settle below $100 a barrel for the first time since mid-March. But the plunge in oil may be enough only to keep pump prices from reaching a national average of $4 a gallon.

The number of people applying for unemployment benefits last week jumped to an eight-month high.

Also, the economy slowed sharply in the first three months of this year. A big reason: High gas prices weakened consumer spending.

That also affected the U.S economy's service sector, which grew last month at the slowest pace since August. Service companies, which employ nearly 90 percent of the work force, cited a decline in customer demand.

Most analysts agree that the economy has strengthened enough to keep growing this year. And many say the factors that held back growth at the start of the year were most likely temporary. They predict growth will pick up over the rest of the year.

There have been some positive signs. Retailers reported strong April sales, helped by a late Easter. Auto companies reported brisk sales. And factories have expanded production this year at the fastest pace in a quarter-century.

Economists' prediction for a pickup in overall growth is based, however, on gasoline prices stabilizing in the months ahead and then dropping to around $3.50 a gallon or lower near the end of the year.

The national average was $3.99 a gallon on Thursday, according to the AAA.

If gas prices keep rising, consumers are likely to spend less on other goods and services. That could prompt companies to hire fewer workers.

Bill Cheney, chief economist at John Hancock Financial Services, said he thinks the economy added around 200,000 jobs in April and is forecasting similar gains in the coming months. A Social Security tax reduction is giving people extra cash to help blunt the impact of higher gas costs, he says. Fatter stock portfolios are also cushioning the blow.

Private companies added more than 200,000 jobs in both February and March, the biggest two-month hiring spree since 2006.

"High gas prices are a big headwind for the economy. It's sucking money out of people's wallets," Cheney said.

Why Does My Gas Cost $4.00 Per Gallon?

May 3, 2011RedState.com - Everybody is asking that question these days. The average nationwide price for all grades this week is $3.96/gallon; Californians are paying on average $4.26, the highest in the nation.

Why does it cost so much, especially considering that the price was below $2.00/gallon just within the last couple of years?

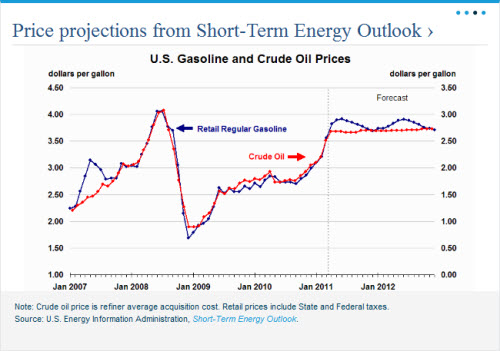

Nearly seventy percent of the price of a gallon of retail gasoline is the price of the crude oil it is refined from. Two graphs from the Energy Information Administration (EIA) make that point. The first shows the price of a gallon of gasoline (left axis) plotted against the price of a gallon of crude oil (right axis). The two move in virtual lock-step; if you know the crude oil price per gallon, add $1.00 and you’ll know the price of gasoline within a few cents. (At $105 per 42-gallon barrel, the per-gallon price of crude is $2.50; add a buck, and you get a gasoline price around $3.50.)

OK, so where does the $1.00 go that’s not paying for the raw product?

Nationwide, the average of state and federal taxes embedded into the price of a gallon of gasoline is 43 cents. We usually think of taxes the other way around, as with sales taxes. If you look at it that way, the effective “sales tax” on gasoline is 13.6%.

But as the next graphic shows, tax burdens vary greatly by state. Californians pay as much as they do at the pump largely because of the difference in state taxes. On top of that, California and a few other jurisdictions levy their tax as a percentage of the sales price (exactly like a sales tax), so that the California state treasury benefits handsomely from a higher gasoline price. (That’s not true in most jurisdictions, where the state tax is a fixed rate per gallon. Also, the tax burden shown in the graphic includes 18.4 cents per gallon in Federal taxes which apply to us all.)

Chances are the next network news report you see concerning high gasoline prices will come from one of the high-tax states on this map.

That leaves about 53 cents per gallon of your retail price that go toward the “downstream” end of the business: refining and marketing. Whether or not that’s a fair price to pay for these services is probably a story for another diary (or another diarist!), but it would be fair to say that the financial returns in the downstream end of the energy business have not been consistently impressive.

$4.00 for a gallon seems expensive, relative to what we are accustomed to paying. But a fair economic analysis of the value of the product must include its utility. A gallon of gas can transport four or more people in relative comfort 20 or more miles, and they can go when and how they wish to go. What is the value of that?

From the perspective of a producer (the “upstream” of the business), it is difficult and expensive to replace a gallon of gasoline in inventory. The price should be high enough to discourage waste, and high enough to reflect the true replacement cost of the resource. Increasingly hostile government policies regarding domestic exploration only increase the cost and difficulty of replacing reserves. An administration which threatens higher taxes on exploration and development dampens drilling plans. Supply tightens, prices go up. The cycle continues.

One last point — even at $4.00, it is difficult to name a liquid product which is cheaper per unit volume than gasoline.

Read More...

No comments:

Post a Comment