The Ruling Class Tactic is to Divide and Conquer

Excavating the Future: Pitting Private & Public Sector Workers Against Each Other

TheFreshExpress.com - ...Here is the American Dream of the future today: no jobs, no prospects, no leverage, no short-term solutions, no long-term plans, no big ideas to save us. While the bottom four-fifths struggle to stay afloat, and the upper one-fifth cautiously tread water, the top 1 percent continue to accumulate wealth at a rate not seen since the Gilded Age.

In the future of today, CEOs earn monster salaries, corporations receive taxpayer welfare, and we have half the U.S. Congress boasting of being millionaires. Meanwhile, medical liabilities bankrupt the rest of us at record levels, one person in ten is out of work, and food stamp usage sets new records every month.

Even with near-record unemployment, the Department of Commerce reported in November 2010 that U.S. companies just had their best quarter… ever. Businesses recorded profits at an annual rate of $1.66 trillion in the third quarter of 2010, which is the highest rate (in non-inflation-adjusted figures) since the government began keeping records more than 60 years ago.

Shrinking incomes, fewer jobs… but bigger corporate profits. Not a good sign. Somehow, many of you have been convinced that the answer is doing more of the same: give more to the rich and we’ll all benefit from the resultant odiferous trickle down. What’s obvious is that the rich are not only dedicated to hanging on to what they have (duh!) but also committed to accumulating more, gets maybe a yawn from the dumb-down, apathetic American voter. In fact, our country’s concentration of wealth is worse than Egypt.

This is nothing but class warfare; and when you try to show, whether through charts and graphs or real-life examples, that the system is rigged in favor of the wealthy and powerful, you’re labeled as unpatriotic, a socialist and/ or communist. What often happens is that, instead of yelling back, “Hell, yes, we’re talking f*cking class warfare!” liberals usually fell over themselves in apology, vehemently denying the accusation. They react as if talking about class warfare is tantamount to treason. Center-right politicians like Obama get spooked and fall in line, saying “Look, Eddie, we can’t do social engineering through the tax code. And there’s no reason to declare class warfare.” It’s pathetic.

The wealth gap has become so alarming that even billionaires like Warren Buffett acknowledge that the Bush-era tax cuts should be allowed to expire. In fact, Buffett contends, the wealthiest Americans should pay even more in taxes. The people in Wisconsin, representative of the majority of Americans, that bottom 4/5 who are barely keeping afloat, are now fighting this fight and it barely registers a yawn from many of you.

Someone suckered us along the way. The future we bought into was great until we fell asleep and woke up to find that at some points the future becomes the present, and the fact that it was once the future doesn’t mean it’s all f*cked up once it arrives.

Report: Inequality Rising Across Developed World

May 4, 2011The Lookout - Here at The Lookout, we've been trying to keep pace with the growing body of evidence suggesting that over the last 30 years, inequality in America has skyrocketed.

But it looks like it's not just here at home that the gap between rich and poor has been growing. According to a new report by the Organization for Economic Cooperation and Development, it's happening across the developed world--though perhaps not at the same rate that the United States is experiencing.

The OECD report finds that in developed countries, the average income of the poorest 10 percent is about nine times that of the richest 10 percent. In the United States, Turkey and Chile, the ratio separating highest and lowest incomes is about 14 to one, and in Chile and Mexico it is 27 to one.

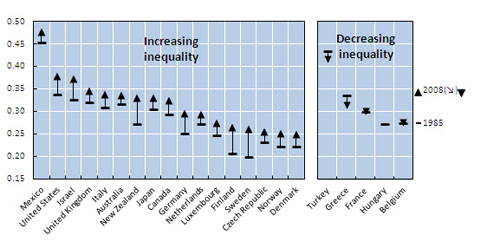

The OECD uses something called the Gini coefficient to measure income inequality. If everyone in a country had the exact same income, the Gini coefficient would be zero. If one person had all the income, it would be 1.

This chart shows that in 17 out of the 22 developed countries for which data is available--the exceptions being Turkey, Greece, France, Hungary and Belgium--the Gini coefficient has risen since the mid 1980s:

The report concludes that the same forces driving inequality in the United States are creating steeper income divisions in other developed countries: Lower-paid workers have seen their wages stagnate, while higher-paid ones have seen their wages rise, often sharply.

In response, OECED recommends changes to tax and benefit policies, contending that tax policy "is the most direct and powerful instrument to increase redistributive effects."

Read More...

No comments:

Post a Comment