Bankrupting the Common People

The Fiction That Home Sales Will Improve

February 25, 201024/7 Wall St. - Anyone who reads the papers or visits news sites on the internet knows that sales of new homes dropped 11.2% in January to a seasonally adjusted annual rate of 309,000. This figure is said to be the lowest level since 1942 by some analysts and the lowest level in 50 years by others.

Economists tried to explain the numbers away and some of their arguments were persuasive. Bad weather kept people from house hunting. If that is so, the figures should pick up in the spring. But, they won’t, at least not by very much.

Recent data from the Mortgage Bankers Association, the government, and other sources show that the default rates and foreclosures on homes are continuing to rise. More than eleven million people now live in houses which have underwater mortgages. Most of these problem loans are in the states where home prices have fallen the most, states which include Michigan, Nevada, California, and Nevada. As foreclosures on underwater mortgages in these states fall, so will home prices.

People are not aggressively shopping for homes because home prices are continuing to fall and default rates and foreclosures are likely to make that problem worse as the year wears on.

Unemployment is mentioned as a reason that more homes are not sold. The impact of joblessness in the housing market is still underestimated. Unlike recessions in the past, many people have been out of work for six months or longer. Economists now admit that millions of jobs which were wiped out in 2007, 2008, and 2009 will never come back. People who are out of work for a long period are not homebuyers, and may well be people whose homes have been foreclosed on, are going into foreclosure, or will go into foreclosure this year.

The trend toward renting and living with relatives as a way to save money is also on the rise as credit remains tight and people look for jobs. Banks are reluctant to offer mortgages to people unless they have large down payments. Most homebuyers are not sitting on large sums of cash, particularly if they have just sold a home which lost most or all of its equity value over the last three yeas. Renting keeps a roof over people’s heads and allows them the flexbility of leaving a house after a year if their financials worsen.

The number of people who live with relatives has increased. Such arrangements were common during The Great Depression when several generations lived under the same roof. It appears that the trend has returned.

Sales of new or existing homes,will remain moribund at least for the rest of this year. There are too many trends that will keep buyers out of the market and falling prices are viewed by many potential buyers as a trap that will catch them with a house which is still losing its value.

Wealth Disparities in U.S. Approaching 1920s Levels

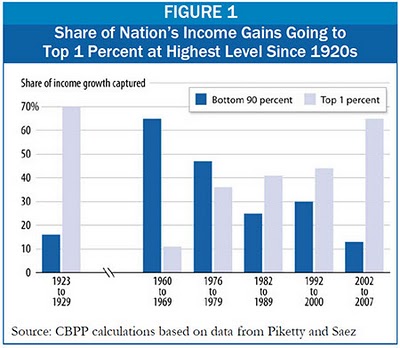

February 21, 2010The Housing Time Bomb, Seeking Alpha - This graph was an eye opener for me (not that I should be surprised):

What a time to be an oligarch! All I wanted to do was vomit when I saw this.

Folks, there is no way we can have economic prosperity in this country when the top 1% has all of the money. The middle class is basically being destroyed right in front of our very eyes. Consumption economies die when the consumers have no money to consume!

I see growing signs of desperation and anger as the wealth of this nation continues to get transferred to the elite of this nation.

People are starting to "lose" it as a result. This past week's airplane event in Austin was a disturbing development. I must admit that I really am not surprised. The government shouldn't be either.

Things are only going to get worse in the violence department as the taxpayers continue to get violated and more desperate as a result of this economic cataststrophe. The news media tried to downplay the actions in Austin.

I think Washington was both surprised and concerned about what took place in Texas.

I have to ask: Should the government really be surpised that an American flew a plane into an IRS building in a fit of rage as we all get repeatedly fleeced by the political and social elites of this country?

Let me preface all of this by saying violence is not the answer here. However, why shouldn't every American be infuriated by what has ocurred since this crisis began?

All the government has done is bail out Wall St. continuously since 2008. My guess is the disparity of wealth in this chart would look even worse if it included 2009. The rest of America has basically been ignored minus a few housing programs to help lower mortgage payments.

That's what's been so frustrating about this whole crisis, and America is finally starting to get it. Just about ALL of the steps that have been taken by the government to help fix this crisis have involved throwing more and more money to the financial elites of this country. I mean, the examples are endless: TARP, AIG, Bank of America, Citi, Freddie, Fannie....Need I say more?

The sheeple are finally realizing that the money is not trickling to them like Washington had promised when they threw billions to the banks. The people have only seen things get worse while Wall St. has prospered. They now want to know where their friggin' bailout is!

They are also realizing that the goverment's actions since this all started in 2007 have done nothing but drop the yields on their CD's to 0%. Gee thanks!

Let's not forget that the sheeple/middle class were also victimized by Wall St. as they were gamed into buying homes they couldn't afford. When this fantasy came crashing down they were again violated as they saw their 401k's get cut in half.

The people of this country can only take so much before they start going postal!

In fact: The Wall Street Journal had an article out yesterday around the increasing threats of violence against the IRS:

WASHINGTON—The federal agency charged with ensuring the safety of IRS employees said it has seen an uptick in the past several years in threats against agency personnel.

In the past four years, there appears to have been a "steady, upward trend" in the number of threats against IRS employees, said an official with the Treasury Department's Inspector General for Tax Administration. That assessment, offered in response to an inquiry from Dow Jones Newswires, is based on preliminary data, the official cautioned.

The middle class in starting to feel like that pledge in the movie Animal House who says "thank you sir, may I have another" after getting repeatedly paddled by his brothers.

Here is the reality that America has realized: If you are not part of the 1% club in this country you are nothing but a victimized pawn as the elite continue to line their pockets with our nation's income.

The middle class now finds themselves struggling to survive as the economy continues to plunge. Nothing has gotten any better despite what the media pundits tell you. Jobs continue to evaporate and foreclosures continue to soar as the middle class in this country continue to get pummeled.

Meanwhile, Wall St. is busy counting their year-end bonuses after making billions gambling the taxpayers' money in 2009 as the sheeple find themselves on the brink of collapse.

The citizens of this country are slowly reaching their breaking point. When Ted Kennedy's Senate seat goes to a Republican you know the people have had it. The poor fellow is now probably rolling over in his grave after seeing a guy from the right take over his office.

The Bottom Line

We are now three years into this crisis, and nothing the government has tried has worked. The market may have recovered (for now) but THE PEOPLE haven't. How much pain do these people in Washington think we can take before we start rising up and begin hanging bankers from the lamp posts?

They need to remember that EVERYONE has a maximum threshold of pain. If there was no such thing then you wouldn't see an MMA fighter "tap out" in the UFC. This country is just about there.

The plane crash in Texas should be taken as a shot across the bow in Washington. I am getting really concerned that we are going to see severe social issues in this nation if we continue down the same path in the very near future.

I would hate to see this because violence is not the answer folks. We need solutions and fast. I don't have all the answers but I know where we can start.

We can start by putting an end to the bailouts of the financial elite. Washington needs to start listening to Main St. instead of top 1%'ers on Wall St. If this creates an economic crisis, so be it. At least it will keep this country solvent.

The government needs to realize that SELLING $118 BILLION IN T-BILLS NEXT WEEK IS NOT THE ANSWER! This simply cannot be maintained over a long period of time. Ponzi schemes never work and they don't solve financial crises. They end in tears.

Washington needs to wake up because we are headed straight off a cliff. Take one more look at the chart above and look what happened the last time the disparity in wealth in this country got this high.

Can you say Great Depression? Remember, the only way an economy can thrive is when the majority of people involved in it are prospering. We are about to drive off the same cliff that we did in the 1920s as the middle class is turned into a group of SERFS. Be prepared.

I need to end it here because I feel my blood pressure rising.

No comments:

Post a Comment