Gingrich Wants to Eliminate the Capital Gains Tax, Which Would Greatly Benefit the Top 1% and Further Increase the Tax Burden on the 99%

Gingrich Proposes New Tax Rate for Mitt Romney: Zero

Crooks and Liars - As the outcry grows over Mitt Romney's shockingly low 15 percent tax rate, his bitter rival Newt Gingrich rushed to his defense.

"My goal is not to raise Mitt Romney's taxes," Gingrich declared," It's to let everybody pay Mitt Romney's rate."Of course, as with his marriage vows, Newt isn't telling the truth. As it turns out, Gingrich has proposed a new capital gains tax rate - zero - that would almost eliminate Mitt Romney's already meager payment to Uncle Sam.

In South Carolina yesterday, Gingrich for once passed on an opportunity to take Mitt Romney to task. As ABC reported:

"We can confirm that I paid a 31 percent rate, and although let me be clear, the 21st century Contract With America has an optional 15 percent for every American," Gingrich said at a press availability in South Carolina. "My goal is not to raise Mitt Romney's taxes. It's to let everybody pay Mitt Romney's rate. And so I'm not going to criticize Mitt Romney. I'm going to say, shouldn't we all have the option of a flat tax at the same rate he was paying."

But that's not what Newt has actually proposed. His optional 15 percent flat tax rate is for ordinary income, not capital gains. And it is the capital gains rate which, thanks to the "carried interest" exemption for private equity managers, accounts for the minimal tax bill Mitt Romney pays on the millions he continues to earn each year from his former employer, Bain Capital.

In a nutshell, President Gingrich wants Governor Romney to pay 15 (and not 35) percent on his regular income and nothing on the millions in investment income that makes up most of his cash flow.

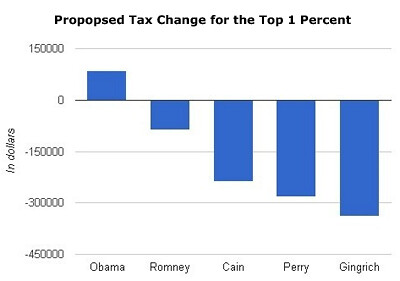

Here's how Gingrich's scheme for a budget-busting payout works for denizens of the gilded class like Mitt Romney. Like his former rival turned supporter Rick Perry, taxpayers could choose to pay an optional flat tax rate (15 percent in Newt's case, 20 percent in Perry's proposal). The corporate tax rate would be slashed from 35 percent to 12.5 percent. Like, Perry, Gingrich would eliminate the capital gains tax altogether. (As the Washington Post recently explained the impact of the already historically low 15% capital gains tax rate, "Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.")

But as Suzy Khimm documented in the Washington Post, Gingrich's plan would produce an ever larger payday for the upper class than Rick Perry, while ensuring the U.S. Treasury hemorrhages even more red ink:

Gingrich preserves deductions for corporations and rich individuals that Perry eliminates: He preserve deductions for charitable giving and mortgage interest to all Americans, whereas Perry only keeps them for families earning less than $500,000. Perry vows to eliminate all corporate tax deductions, while Gingrich would preserve them. As such, corporations and the richest Americans could stand to benefit even more under Gingrich's plan than Perry's.

Under Perry's plan, those with more than a million in income would save $500,000 in taxes by 2015, due to a 60 percent drop in their tax rate, and those benefits would be even bigger under Gingrich. According to the Tax Policy Center, Perry's plan would lower total projected government revenue by 27 percent--a $1 trillion loss in 2015 alone. Gingrich's plan, accordingly, would result in even bigger revenue loss.

Roberton Williams of the Tax Policy Center concurred with that assessment, concluding,

"You would have about three-quarters of the revenue you would have under Perry, so you have a much bigger revenue hole."

In October, Citizens for Tax Justice previewed Romney's admission on Tuesday, estimating that he paid only 14 percent of his total income in taxes. (It's no wonder Mitt opposes the "Buffett Rule.") As Time reported:

Just how much Romney pays in taxes is, for the moment, a private matter. But his income is public knowledge. In August, Romney disclosed that in 2010 he and his wife made between $1.1 million and $2.8 million in royalties, salary, speaking fees and interest, most of which was likely taxed at a marginal rate of 35%, after accounting for deductions. The Romneys made an additional $5.5 million to $37.3 million from dividends and capital gains, which is generally taxed at a much lower rate of 15%.

Not if President Gingrich gets way. Romney's tax bill would plummet, if not to a rate of zero, to the low single digits.

This is not to say Citizen Romney wouldn't benefit from having President Romney in the White House. An analysis by Citizens for Tax Justice found that Romney's taxes would be cut by almost half under his current proposals. And that doesn't include the $84,000,000 windfall Romney's five sons and 17 grandchildren would receive by their patriarch's elimination of the estate tax. (Ending the estate tax is also part of Newt's plans.)

At the end of the day, losing the White House to Newt Gingrich will hurt Mitt Romney's ego. But as the numbers show, nothing could be better for his bottom line.

Read More...

No comments:

Post a Comment